Whether you’re a fresher or a final year student, if you’re stressing about finances, worrying about getting through university on next to no income, or struggling to pay for that next Tesco meal deal, then fret no more. I’m here to show you some practical methods I use to look after my money at uni, and hopefully you can use them too!

“Those who don’t manage their money will always work for those who do.” – Some wise financial prophet.

I’m a little bit of a geek when it comes to money. I’ve read a fair few finance books/blogs and have taken what I’ve learned from other people and tried to apply it to my own life and now hopefully you can do the same. I know this is a beige topic, but stick with me, it’ll be worth it! If you want financial freedom, you need financial discipline.

The general framework for managing your money at university (or in life in general) is very simple. The first step is FIGURE OUT YOUR INCOME!

Income

In other words, figure out how much money you have coming in each term. It doesn’t matter if it’s £10 or £1000, you need to assess your income and then go from there. Make sure you cover all bases, including part-time work, maintenance loan, allowances from parents, birthdays, Christmas etc. This does not include your overdraft! Save this for real emergencies. Once you have a grand termly total, you need to FIGURE OUT YOUR OUTGOINGS.

Spending

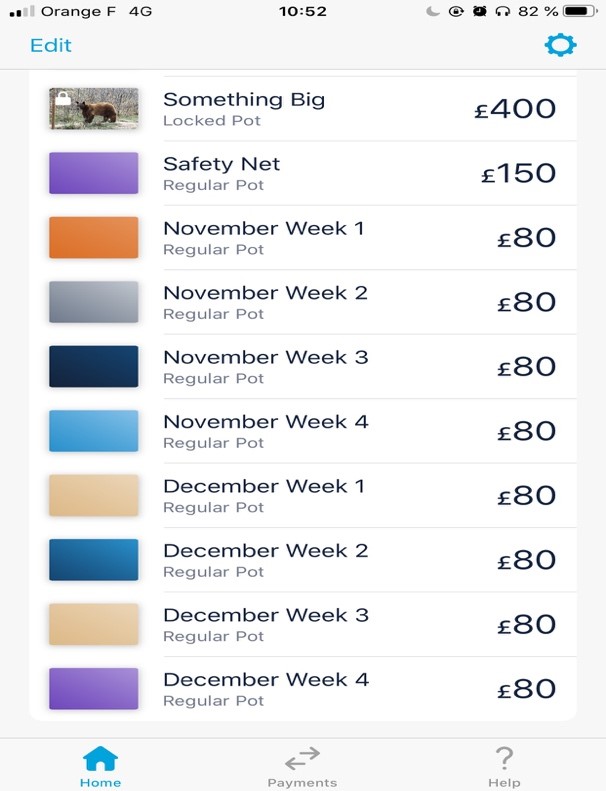

Spend a little more time on this one as it’s probably the most important. I understand this can only be a guess-timate, but try to be as accurate as possible – you don’t want any nasty little surprises down the road. Split your outgoings into two main groups: ESSENTIAL SPENDING and NON-ESSENTIAL SPENDING. Apps like MONZO do this automatically for you, but you can always do it the old-fashioned way and make notes of your average monthly spending. (Disclaimer: I’m not endorsed by MONZO, but I think it’s a great tool to have, so check it out).

ESSENTIAL SPENDING includes things like rent, food, utility bills, subscriptions (think Netflix, Spotify and gym memberships), etc. NON-ESSENTIAL SPENDING is everything else: clothes, going out, restaurants, coffee dates, Ubers etc. The next step is where it gets tasty. CALCULATE YOUR WEEKLY BUDGET.

Weekly budget

Work out your TOTAL INCOME for a term at university. Minus the ESSENTIAL SPENDING. Divide the number you’re left with by 10 (there are 10 weeks per term at Durham).

Let’s say your total income per term is £2,500. Minus £1,500 for essentials. This leaves £1000 (divide by 10) = £100 a week. BOOM! That’s what you’ve got to play with. I recommend creating a pot for every week of the term in an app like MONZO, setting up a direct debit from your student account to your current account, or taking out £100 in cash every Sunday/Monday. BUT, here’s the thing, I personally believe you’d be hard pushed to spend £100 every week. Let’s see… OK, so you get a meal deal from Tesco on Monday (£3), you go out and buy 10 drinks at Klute on Tuesday (£10), then a coffee with a pal at Leonard’s on Wednesday (£2.85), maybe get a Domino’s Thursday (£15) and then out to Players on Friday (£25-30 – if you’re splashing out). And let’s assume you spend maybe £20 over the weekend. TOTAL = £75-80 a week. Sure, you can spend more, but this is just an example.

So, the question remains… What do you do with that extra £20? This brings us nicely to the next step.

Save it for a rainy day

This should be the first thing on your weekly to-do list: Set this £20 aside, whether it’s as cash in a jar, or in a savings account. Whatever it is, save it. Maybe you want to buy a car in summer, or get that new laptop, or to go to Malaga with friends in the summer and need to save. By the time July comes around you will have saved a grand total of £600! You’ll be laughing! Once the £20 is tucked away, then you can spend that £80 guilt free!

So, there you have it. A very simple 4 step plan to financial savviness. It takes very little effort, maybe 30 minutes to an hour at the beginning of every term, and it will save you so much time and hassle in the future.

Follow the advice in this blog and you’ll be financially free in no time.

There are loads more on how to look after your money and how to save more and spend less, but I think I’ll save that for another day. In the meantime, do a bit of research online, there’s heaps out there for free. I realise this probably reads the same as every other “student blog” out there on the internet. But, there’s a reason these all look the same: This works. It is tried and tested and is proven to make you more money savvy and financially free. Discipline equals freedom. If you take nothing else from this blog, at least take that one piece of advice.

The photos are of me enjoying some guilt-free trips around the world in 1st and 2nd year courtesy of my budgeting plan and savings! Now you can do it too!

Find out more

Read part 2 of Rob’s brilliant budgeting advice here.

Download our latest prospectus here.

Follow our students on Instagram and YouTube.